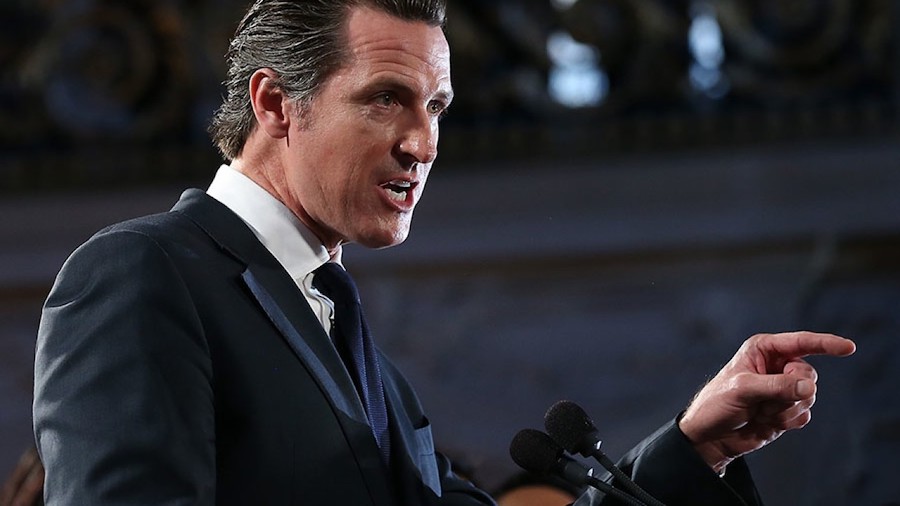

This week, both houses of the California state legislature passed the Debt Collection Licensing Act (SB 908), a bill that makes California one of 35 states to require a license in order to practice debt collection. Governor Gavin Newsom is expected to sign the bill into law.

Deriving its authority from an existing law, the Rosenthal Fair Debt Collection Practices Act, SB 908 requires debt collectors and debt buyers to obtain a license from the California Department of Business Oversight (DBO). The text of the bill enumerates some of its other key provisions, including:

- “This bill would include placing a telephone call without disclosing the caller’s identity, as specified, and sending digital or written communications that do not display the license number of the debt collector in at least 12-point type as prohibited debt collection practices.”

- “The bill would establish the Debt Collection Advisory Committee, consisting of 7 members appointed by the commissioner, within the Department of Business Oversight to advise the commissioner on matters relating to debt collection, as specified.”

- “This bill would require each licensee to, among other things, file reports with the commissioner under oath, maintain a surety bond, and pay to the commissioner its pro rata share of all costs and expenses reasonably incurred in the administration of these provisions, as estimated by the commissioner.”

- “The bill would authorize the commissioner to enforce these provisions by, among other things, adopting regulations, performing investigations, suspending a license, issuing orders and claims for relief, and enforcing the provisions, as specified.”

The California Association of Collectors (CAC) actually worked with legislators in crafting the bill, under the reasonable assumption that it would pass regardless of any lobbying against it. As a result, the CAC was able to dissuade the legislature from including potentially onerous provisions such as allowing minor Fair Debt Collection Practices Act (FDCPA) violations to result in a loss of license; a mandatory, biennial state audit; and a requirement preventing a family of companies from sharing a license, among others.

The CAC was also able to convince the legislature to delay the licensing date by one year. If signed into law by the governor, the Debt Collection Licensing Act will take effect on January 1, 2021. The DBO will begin putting together the infrastructure and procedures for licensing and licenses will be required starting on January 1, 2022.