A Telephone Consumer Protection Act (TCPA) ruling this week in a federal court in Rhode Island affirmed that state law does allow for criminal penalties for debt collectors who fail to register as such under the state’s laws. The court found that the plaintiff could sue the defendant in Laccinole v. Gulf Coast Collection Bureau… Continue reading Court Affirms Criminal Penalties in Rhode Island for Not Registering as a Debt Collector

Tag: Collections

FCC Tells Service Providers to Shut Off Traffic for Student Loan Scam Robocallers

On Thursday November 10, the Enforcement Bureau of the Federal Communications Commission (FCC) issued a public notice notifying U.S.-based voice service providers that they may block robocalls from a particular voice service provider whom the FCC had identified as being responsible for scam calls relating to student loans. The notice identifies Urth Access, LLC as… Continue reading FCC Tells Service Providers to Shut Off Traffic for Student Loan Scam Robocallers

Recent Class Certification Against Bank Shows Risks of Wrong Numbers and Reassigned Numbers

A recent class certification ruling by the District Court in Arizona demonstrates several of the most dangerous aspects of the Telephone Consumer Protection Act (TCPA). The case—Head v. Citibank—stems from alleged violations committed by a bank while making collections calls. The class contains over a million people, many of whom may have received more than… Continue reading Recent Class Certification Against Bank Shows Risks of Wrong Numbers and Reassigned Numbers

CFPB’s Regulation F Debt Collection Rule Goes into Effect November 30

Last year, the Consumer Financial Protection Bureau (CFPB) released the final version of Regulation F, a significant rule updating the Fair Debt Collection Practices Act (FDCPA). The rule addresses how debt collection regulations relate to the changes in communication technology since the FDCPA’s initial passage into law in 1977. It will take effect on November… Continue reading CFPB’s Regulation F Debt Collection Rule Goes into Effect November 30

Appeals Court Rules That TCPA Was Constitutional Between 2015 and 2020

A U.S. Circuit Court of Appeals has finally weighed in on one of the most significant current legal questions regarding the Telephone Consumer Protection Act (TCPA) and has handed down an unfavorable ruling to callers.

Arbitrator Rules That Plaintiffs in Manufactured TCPA Lawsuit Must Pay Defendants $286,000

In a reversal from how these things usually go, an arbitrator has ruled that the plaintiff in a Telephone Consumer Protection Act (TCPA) lawsuit must pay the defendant $286,064.62. The arbitrator determined that this serial plaintiff had perpetrated a scheme in which he induced the defendant to call him over 600 times in order to… Continue reading Arbitrator Rules That Plaintiffs in Manufactured TCPA Lawsuit Must Pay Defendants $286,000

T-Mobile May Block All Debt Collection Text Messages to Its Users

In November of last year, telecommunications carrier T-Mobile quietly made a change to its Code of Conduct that could potentially have enormous consequences: it listed debt collection among what it considers to be “disallowed content.” As a result, it is possible that T-Mobile will block all debt collection text messages—even those that are legal and… Continue reading T-Mobile May Block All Debt Collection Text Messages to Its Users

Recent TCPA Cases Demonstrate Risk of Personal Liability for Corporate Officers

One of the more harrowing particularities of litigation of telemarketing regulations is the fact that corporate officers can occasionally be found personal liable for violations by their employees. Two recent cases provide evidence of this sort of risk. Once case—Ramsey v. Receivables Performance Mgmt., LLC, Case No. 1:16-cv-1059, 2020 U.S. Dist. LEXIS 236094 (S.D. Oh.… Continue reading Recent TCPA Cases Demonstrate Risk of Personal Liability for Corporate Officers

CFPB Releases Final Debt Collection Rule

The Consumer Financial Protection Bureau (CFPB) released the final version of a debt collection rule that was last seen in proposed form back in May 2019. The rule, known as Regulation F, is a major update to the Fair Debt Collection Practices Act (FDCPA). This 653-page rule primarily serves to address how the law applies to… Continue reading CFPB Releases Final Debt Collection Rule

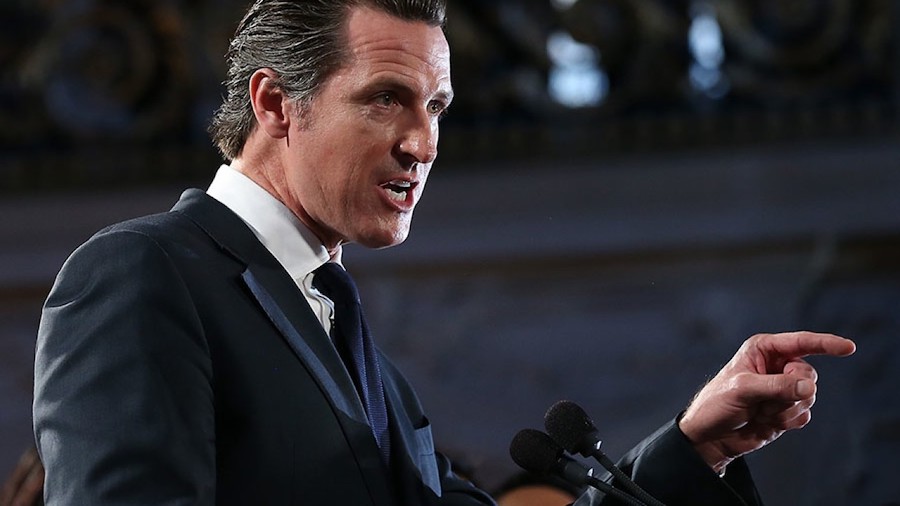

California Legislature Passes Debt Collection Licensure Law

This week, both houses of the California state legislature passed the Debt Collection Licensing Act (SB 908), a bill that makes California one of 35 states to require a license in order to practice debt collection. Governor Gavin Newsom is expected to sign the bill into law. Deriving its authority from an existing law, the… Continue reading California Legislature Passes Debt Collection Licensure Law