This is the way Barr v. AAPC ends This is the way Barr v. AAPC ends This is the way Barr v. AAPC ends Not with a bang but with a whimper. After all the legal wrangling and parsing of oral arguments, the Supreme Court handed down a decision today in a case that had… Continue reading SCOTUS Strikes Down Debt Exemption, Upholds TCPA as a Whole

Tag: Collections

Court Invokes TCPA Debt Exemption Despite Imminent SCOTUS Ruling

While everybody waits to see if the government-backed debt exemption leads to the Supreme Court potentially invalidating the Telephone Consumer Protection Act (TCPA) entirely, a district court somewhat surprisingly decided to enforce that same debt exemption. In Tillman v. Navient Sols., LLC, No. 18-CV-04625, 2020 U.S. Dist. LEXIS 104533 (N.D. Ill. June 15, 2020), the… Continue reading Court Invokes TCPA Debt Exemption Despite Imminent SCOTUS Ruling

Minnesota Extends Work-From-Home Order and Clarifies Procedures for Debt Collectors

Last Friday, the Minnesota Department of Commerce issued Regulatory Guidance 20-27 clarifying remote work procedures for the debt collection industry and extending that guidance to cover Governor Tim Walz’s extension of the state’s COVID-19 peacetime emergency declaration. Governor Walz initially declared a peacetime emergency due to the COVID-19 crisis on March 13, 2020. On March… Continue reading Minnesota Extends Work-From-Home Order and Clarifies Procedures for Debt Collectors

Judge Rules That Massachusetts’ Emergency Debt Collection Ban Is Unconstitutional

At the end of March, Massachusetts Attorney General Maura Healey filed emergency regulations banning the collection of consumer debt during the COVID-19 crisis, including a 90 day ban on debt collection calls and text messages to Massachusetts residents. Last week, a judge issued an injunction preventing the Attorney General from enforcing that ban. The injunction… Continue reading Judge Rules That Massachusetts’ Emergency Debt Collection Ban Is Unconstitutional

Collections Compliance: the Laws that Govern the Collections Industry

Both telemarketing and debt collection are, quite literally, risky businesses. Both fields are highly regulated, governed by complex legislation, and subject to potentially expensive penalties and litigation. Compliance in either field is complicated enough on its own but compliance for debt collectors who use telephone solicitation in order to conduct their business imposes difficulties to an extent beyond the mere sum of the complexities of either field on its own.

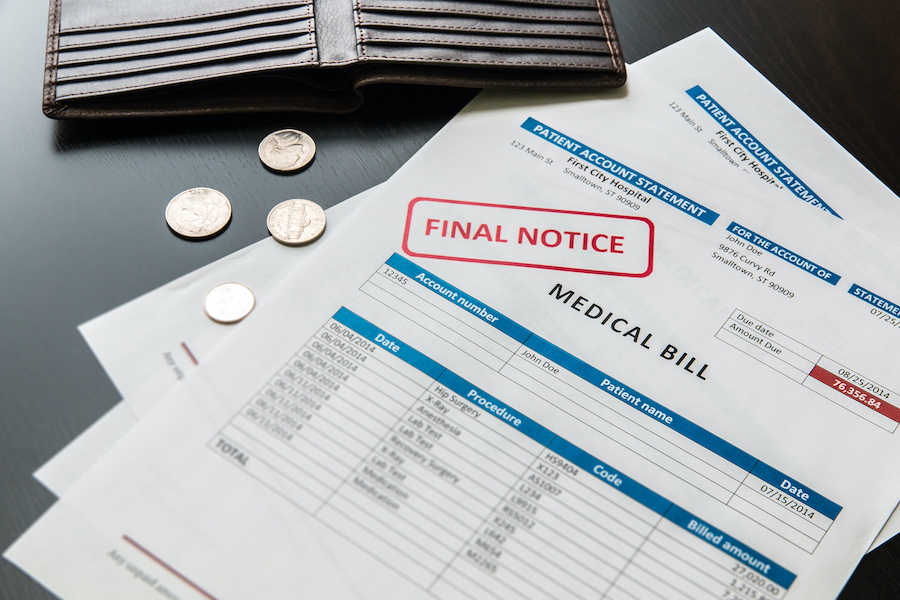

New York State Reduces Medical Debt Statue of Limitations to Three Years

The legislature of the state of New York and Governor Andrew Cuomo enacted the state’s 2021 Executive Budget. Among the budget’s provisions is one that reduces the statute of limitations from six years to three years for collections lawsuits on medical debt. This legislative change takes the form of an addition (§ 213-d ) to… Continue reading New York State Reduces Medical Debt Statue of Limitations to Three Years

Court Awards $89 Million Attorney Fee in TCPA Case

Throughout the various ups and downs of Telephone Consumer Protection Act (TCPA) litigation, federal and state regulatory actions, and precedent-setting court decisions, one of the few consistent truths is that plaintiff attorneys make money hand over fist. A recent case strongly reinforces that truth, with a court entering an order approving a fee of nearly… Continue reading Court Awards $89 Million Attorney Fee in TCPA Case

The TCPA During the Coronavirus Pandemic

The current, novel coronavirus pandemic that is spreading COVID-19 is causing massive upheaval worldwide. For telemarketers, this is creating uncertainty as to how regulations such as the TCPA and state laws dictate what sorts of calls are allowed during such a period of emergency.

California District Court Rules that Revocation of Consent for One Account Doesn’t Automatically Apply to All of Plaintiff’s Accounts

A California District Court handed down a ruling in a debt collection-related Telephone Consumer Protection Act (TCPA) case that potentially sets a clarifying precent on how revocation of consent applies to debtors with multiple accounts. The case—Henry Mendoza v. Allied Interstate LLC, et al., Case No. SACV 17-885 JVS, Doc. No. 64 (C.D. Cal. Oct.… Continue reading California District Court Rules that Revocation of Consent for One Account Doesn’t Automatically Apply to All of Plaintiff’s Accounts

California Court Applies Broad Definition of ATDS from Marks

A new decision by the Eastern District of California made use of the Ninth Circuit’s broad definition of what constitutes an automatic telephone dialing system (ATDS) from last year’s Marks v. Crunch San Diego decision. The Court’s decision to grant the plaintiff’s motion for summary judgement in a new case provides further evidence of the… Continue reading California Court Applies Broad Definition of ATDS from Marks